Posted on the 9th December 2025 in PHTM News

HMRC OFFERS TIME TO HELP YOU PAY YOUR TAXI BILL

Self Assessment customers can spread the cost of their tax bill with HMRC’s Time to Pay service.

The deadline to file and pay any tax owed is 31 January 2026, but people who are unable to pay in full by then may be able to set up a Time to Pay arrangement online and spread the cost over monthly instalments.

Better still, for those with bills of up to £30,000, such an arrangement can be set up without even needing to contact HMRC directly.

Since 6 April 2025 nearly 18,000 payment plans have been set up using the service, helping customers avoid late payment penalties by arranging regular payments that suit their own circumstances.

A Time to Pay arrangements can’t be set up until a Self Assessment return has been filed. If the tax owed is more than £30,000, or a longer repayment period is needed, people can still apply but will need to contact HMRC directly.

Myrtle Lloyd, HMRC’s Chief Customer Officer, said:

“We’re here to help customers get their tax right. If you are worried about paying your Self Assessment bill, assistance is available. Our online payment plans offer financial flexibility and can be tailored to individual circumstances. We want to support all our customers in meeting their tax obligations with confidence.”

There are many ways to pay a Self Assessment bill, including the free and secure HMRC app or online at GOV.UK. A full list of payment options is available on GOV.UK.

HMRC encourages customers to file their tax return early to avoid last-minute stress and to know what they owe sooner. This doesn’t mean that the tax needs to be paid before the deadline though – it is still due on 31 January.

Online help and support, including YouTube videos explaining how to pay a tax bill, are available for anyone completing their return, including first-time filers.

Both Self Assessment and Simple Assessment payments can be made in full or in instalments by the deadline.

People are reminded to stay safe from scams. Criminals use emails, phone calls, and texts to try to steal information and money from taxpayers. HMRC’s guidance on tax scams is always check before sharing personal or financial details and never share HMRC login information with anyone.

Simple Assessment:

HMRC is also reminding anyone who received a Simple Assessment letter that the deadline to pay any tax owed is 31 January 2026. Simple Assessment customers do not need to register and complete a tax return.

Simple Assessment letters were issued to those who have unpaid Income Tax from the 2024 to 2025 tax year that cannot be collected via Pay as You Earn (PAYE) – by an employer or pension provider.

Customers who receive a Simple Assessment on or after 31 October 2025 for tax owed during 2024 to 2025 tax year will have 3 months from the date of their assessment to pay their tax bill.

Both Self Assessment and Simple Assessment payments can be made in full, or in smaller amounts if the balance is cleared before the deadline. Payments can be made on GOV.UK or through the HMRC app.

Read another story

- INVERCLYDE TAXIS SET FOR POTENTIAL NEW FARE HIKE JUST ONE YEAR AFTER 7% RISE

The council’s general purposes board is due to consider the report on December 10, which confirms that representatives of the taxi trade "have now been requested to submit their views.

- REPORT WARNS OF RAPIDLY GROWING GHOST NUMBER PLATE CRISIS AS 41% LONDON CABBIES ARE NON COMPLIANT

An "explosive" new report lays bare the "serious safety concerns" of the UK's "outdated and poorly regulated number plate system," warning it enables criminals to operate undetected.

- ARREST IN COLD CASE: MAN 76 CHARGED WITH 2008 MURDER OF TIPTON TAXI DRIVER

David Harrison, from Bilston, is accused of killing 39-year-old Mr. Khan. The victim "was shot outside his Tudor Street home at 9.25pm on March 3, 2008, and later died at hospital."

- UNSAFE TYRE LEADS TO IMMEDIATE SUSPENSION OF LANCASHIRE TAXI LICENCE

The driver was penalised after officers discovered that the treads on one of his tyres measured a mere "0.8mm," well below the legal limit.

- CHRISTMAS SAFETY ALERT: EAST RIDING COUNCIL WARNS OF BOGUS TAXI DRIVERS

The council has noted an annual rise in reports of "bogus vehicles purporting to be lawful taxi services" during the holiday period.

- CHARITY DEMANDS LICENCE REVOCATION FOR COVENTRY CABBIES WHO REFUSE GUIDE DOGS

The charity highlighted that 9,410 people in Coventry currently live with sight loss, a figure predicted to rise to 10,800 by 2032.

- HEATHROW HIKES DROP OFF FEE TO 7 AND CUTS WAIT TIME LABELLED UNJUSTIFIABLE MONEYMAKER

Motoring campaigners and taxi drivers have fiercely criticised the steady fee increases, arguing that passengers will ultimately be forced to "shoulder the costs."

- TAXI DRIVERS PUSH BACK: PETITION DEMANDS DELAY TO SLOUGH'S DIESEL CUT OFF POLICY

The petition argues that Slough’s cut-off is “stricter and more costly” than neighbouring authorities, adding that drivers and operators will be asked to “bear high costs” to upgrade their vehicles.

- CUT OFF THE UBER APP: COTSWOLD CABBIES DEMAND BAN OVER FEARS OF OUT OF AREA DRIVERS

Licensed drivers in the Cotswolds are demanding a local ban on the Uber app, claiming they are losing "thousands of pounds" due to competition from drivers licensed in distant areas

- LEVC BACKS GREATER MANCHESTER'S CLEAN TAXI PLANS WITH UP TO £2M CONTRIBUTION

London EV Company (LEVC) has signed a memorandum of understanding with the Greater Manchester Combined Authority, backing the city-region's £8m Hackney Support Fund.

- GOVERNMENT MOVES TO TIGHTEN TAXI LICENSING WITH RIGOROUS VETTING TO TACKLE OUT OF AREA DRIVERS

The Government has issued a statement detailing its plans to overhaul taxi licensing under The English Devolution and Community Empowerment Bill, specifically aiming to tackle the controversial issue of 'out-of-area' wor

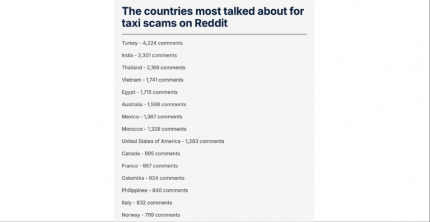

- REVEALED THE WORLD'S WORST PLACE FOR TAXI SCAMS AND HOW TO AVOID THE BROKEN METER TRICK

New research analysing Reddit travel discussions has named Turkey as the country where tourists most frequently report falling victim to taxi scams.

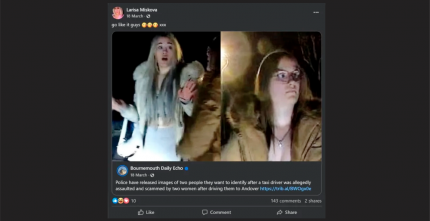

- BOURNEMOUTH FARE DODGERS EXPOSED AFTER ONE SHARES POLICE APPEAL ON FACEBOOK

Larisa Sumovskaja, 18, and Jasmine Orchard, 21, took a taxi home after a night out, but left the vehicle without paying the £38 fare.

- TORBAY TAXI DRIVER'S LICENCE SUSPENDED AFTER 19 COMPLAINTS IN SIX WEEKS

The unnamed driver's licence is suspended for three months, though she may return sooner if she completes training.

- GLASGOW MOVES TO MAKE CARD PAYMENTS MANDATORY FOR TAXIS

Glasgow taxi drivers could soon be required to accept card payments after the city's licensing committee officially agreed to hold a public consultation on the issue.

- SHETLAND TAXI FARES POISED FOR FIRST RISE SINCE 2022 AMID SURGING COSTS

The move is being driven by "significant increases in the cost of vehicles and maintenance, fuel and the cost of living," according to a Shetland Islands Council (SIC) report.

- PETERBOROUGH COUNCIL VOTES TO URGE GOVERNMENT FOR NATIONAL STANDARDS AND FUNDING FOR CCTV

The motion, spearheaded by Labour councillor Mohammed Jamil, requires the city council to write to the Secretary of State for Transport and two local MPs, urging their support.

- TAXI ENGULFED IN FLAMES AT TRAIN STATION IN EAST KILBRIDE AFTER PASSENGER ALERTS DRIVER

Footage captured the vehicle entirely "enveloped in flames" as firefighters arrived on the scene to tackle the intense blaze.

- BASINGSTOKE COUNCIL TO PAY OVER £270K FOR RACIAL DISCRIMINATION AGAINST TWO BLACK PH DRIVERS

The claimants, Miss O Akinleye and Mr A Olumade, pursued an employment tribunal against BDBC alleging sex discrimination, race discrimination, harassment, and victimisation.

- WAKEFIELD COUNCIL LICENSING OFFICER ACCUSES ELECTED MEMBERS OF BEING "CORRUPT"

Several members of the Wakefield taxi & private hire trade were at the meeting and one was so angry and concerned at what was said by this licensing officer that he has lodged the complaint.